Investment Objective

The fund’s objective is to seek long-term capital appreciation.

Investment Strategy

The fund aims to provide a dynamic core exposure to equity markets around the globe and global fixed income to achieve above-average risk-adjusted returns. The Innealta Investment Committee selects exposures in country equity markets, and segments of those markets, as well as global fixed income sectors based on the perceived opportunities of return, risk, and correlation. Our Investment Committee utilizes a proprietary quantitative framework that provides a holistic view of financial markets. The investment objective of the fund is capital appreciation.

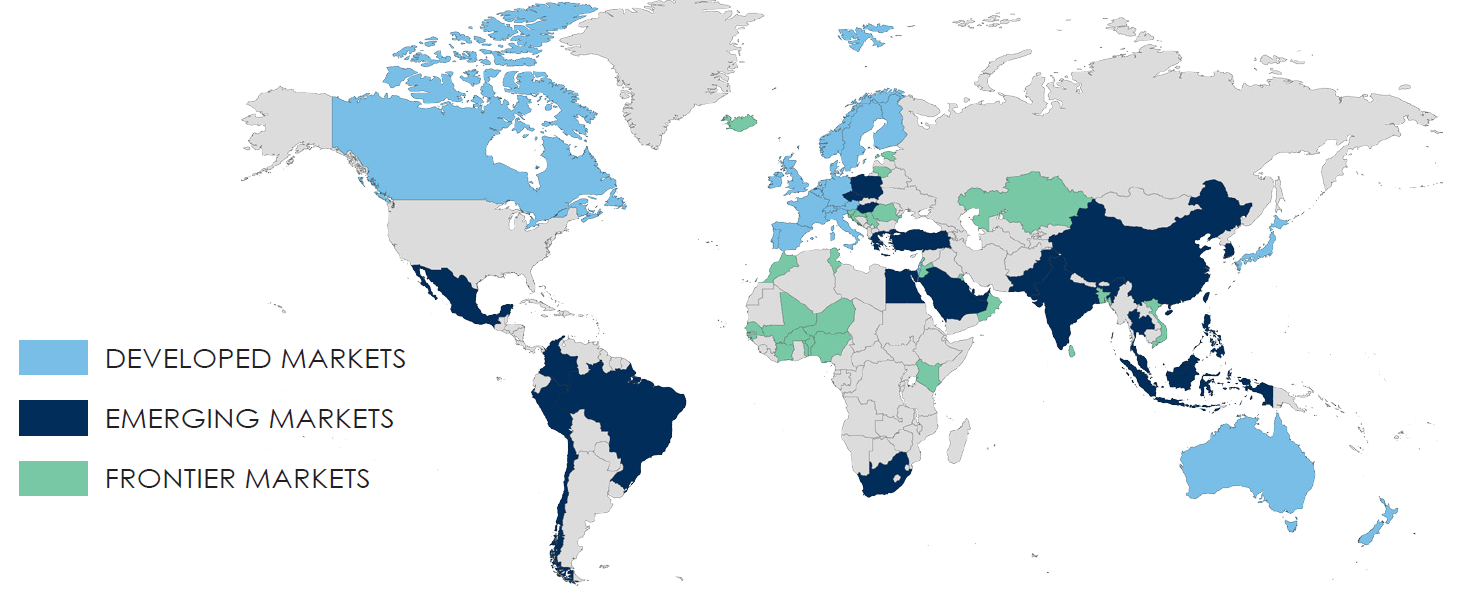

Investment Universe

The fund primarily invests in over 40 international equity markets, including developed and emerging economies, as well as in the 3 major sectors of the global fixed income market.

Fund Facts

| Class N | Class I | |

| Ticker | ICCNX | ICCIX |

| CUSIP | 66538A810 | 66538A828 |

| Inception | 12/30/2011 | 12/30/2011 |

| Minimum* | $5,000 | $20,000 |

| Gross Expense Ratio | 1.90% | 1.64% |

| Net Expense Ratio | 1.78% | 1.53% |

The Fund’s investment adviser has agreed to waive its fees and/or absorb expenses of the Fund to ensure that Total Annual Fund Operating Expenses (excluding any front-end or contingent deferred sales loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes and extraordinary expenses such as litigation) for the Dynamic International Opportunity Fund do not exceed 1.49%, and 1.24%, of the Fund’s average net assets, for Class N and Class I shares, respectively, through April 30, 2025. The net expense ratio is contractual. This operating expense limitation agreement can be terminated only by, or with the consent of, the Board of Trustees. The Adviser is permitted to receive reimbursement from the Dynamic International Opportunity Fund for fees it waived and Fund expenses it paid, subject to the limitation that: (1) the reimbursement for fees and expenses will be made only if payable within three years from the date the fees and expenses were initially waived or reimbursed; and (2) the reimbursement may not be made if it would cause the expense limitation in effect at the time of the waiver or currently in effect, whichever is lower, to be exceeded.

*Innealta Capital maintains distribution agreements with selected platforms where minimums may be waived for some clients in certain share classes. Please contact us for more details.

Fund Documents

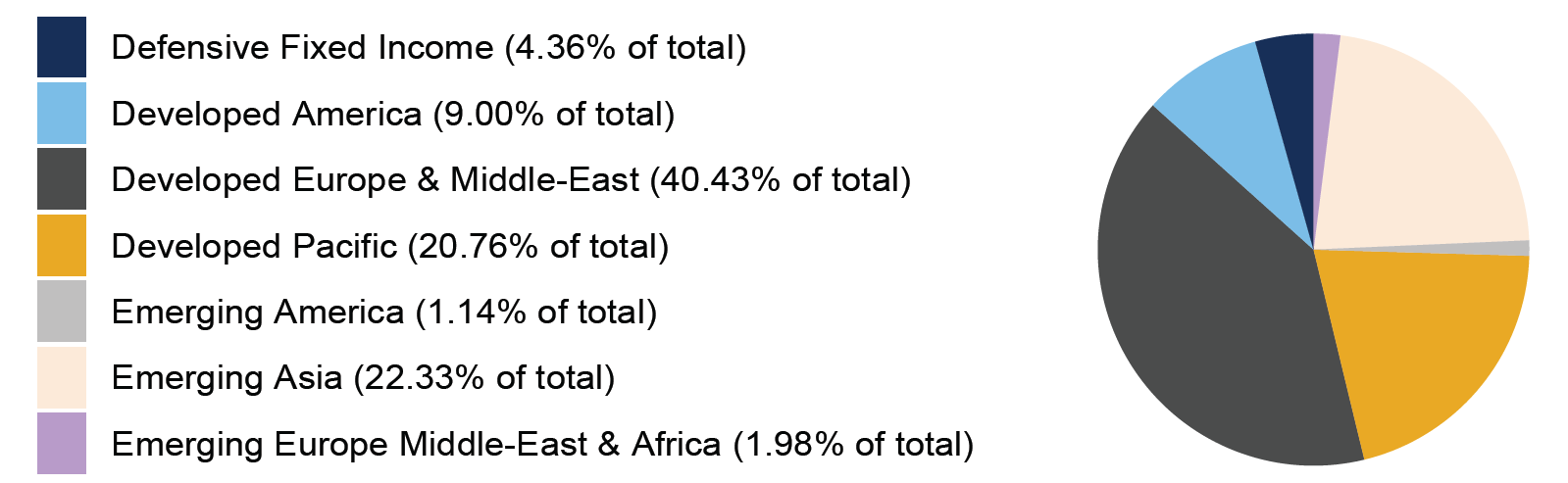

Holdings

Holdings and allocation data as of March 31, 2025. Fund holdings are subject to change and should not be considered investment advice.

Risk Statistics [1]

| Relative to ACWI ex-US | Relative to Blend | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Volatility (%) | Average Drawdown (%) | Sharpe Ratio | Alpha (%) | Beta | Correlation | Capture Ratio | Alpha (%) | Beta | Correlation | Capture Ratio | |

| ICCIX | 11.57 | 8.29 | 0.41 | -1.65 | 0.72 | 0.96 | 0.90 | 0.26 | 0.87 | 0.96 | 0.99 |

| ACWI ex-US [2] | 15.40 | 10.03 | 0.58 | 0.00 | 1.00 | 1.00 | 1.00 | 2.76 | 1.20 | 0.99 | 1.11 |

| Blend[3] | 12.71 | 9.08 | 0.41 | -2.15 | 0.82 | 0.99 | 0.91 | 0.00 | 1.00 | 1.00 | 1.00 |

As of March 31, 2025

Performance

| Return (%) | 3-Month | YTD | 1-Year | 3-Year | 5-Year | 10-Year |

| ICCIX | 4.80 | 4.80 | 3.90 | 3.26 | 6.92 | 4.13 |

| ACWI ex-US [2] | 5.23 | 5.23 | 6.09 | 4.48 | 10.92 | 4.98 |

| Blend [3] | 4.45 | 4.45 | 5.19 | 2.69 | 7.21 | 3.87 |

As of March 31, 2025

Performance and Risk Statistics as of March 31, 2025. Past performance information provided for the periods prior to March 28, 2018 reflects the performance of the Fund’s prior investment adviser, AFAM Capital, Inc. (“AFAM”), and specifically the Innealta Capital division of AFAM (“Innealta Division”). On March 27, 2018, shareholders approved the new investment advisory agreement with Innealta Capital, LLC which was formed through a reorganization of the Innealta Division. Prior to the reorganization, the Fund was managed by the principals of the Innealta Division, now the principals at Innealta Capital, LLC., who were primarily responsible for the performance results. Innealta Capital, LLC intends to pursue the same investment strategy that was pursued while its principals were employed by AFAM.

The performance data presented in the tables represents past performance net of all fees, including any acquired fund fees. Past performance is no guarantee of future results. Current performance may be lower or higher than the data cited above. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call 855.873.3837.

DISCLOSURES & IMPORTANT INFORMATION

[1] Risk Statistics are supplemental and calculated using monthly data, based on 5-year trailing returns.

[2] MSCI ACWI ex-US NR Index (see below for complete definition).

[3] 70% MSCI All Country World ex-USA NR Index / 30% Bloomberg Barclays Global Aggregate Bond NR Index, rebalanced quarterly (see below for complete definition).

Innealta Capital, LLC is an Investment Adviser, registered with the Securities & Exchange Commission. For more information, please visit our website: innealtacapital.com.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Innealta Funds. This and other important information about the Funds is contained in the prospectus, which can be obtained by calling 855.873.3837. The prospectus should be read carefully before investing.

The Innealta Funds are distributed by Northern Lights Distributors, LLC a FINRA/SIPC member. Innealta Capital, LLC is not affiliated with Northern Lights Distributors, LLC.

GLOSSARY & RISK CONSIDERATIONS

The MSCI ACWI ex-US NR Index captures large- and mid-cap representation across 22 of 23 Developed Markets countries (excluding the US) and 24 Emerging Markets countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. Net total return indexes reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The Bloomberg Barclays Global Aggregate Bond NR Index is a measure of global investment grade debt from twenty-four different local currency markets. Net total return indexes reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Unmanaged index returns do not reflect any fees, expenses or sales charges, and it is not possible to invest directly in an index.

Alpha is a measure of the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta. Beta is a measure of volatility, or systematic risk, of a portfolio in comparison to a benchmark. A beta greater than one indicates more volatility, while a beta less than one indicates less volatility than the relevant benchmark. Volatility refers to the standard deviation of (daily/monthly) total returns on an annualized basis using a (252/12) annualization factor. Sharpe Ratio is a measurement of reward per unit of risk as calculated by the average monthly excess return divided by the monthly standard deviation of excess returns. Capture Ratio is the ratio of upside capture to downside capture. Upside capture is the statistical measure of an investment manager’s overall performance in up-markets. The upside capture ratio is used to evaluate how well an investment manager performed relative to an index during periods when that index has risen. Downside capture is a statistical measure of an investment manager’s overall performance in down-markets. Downside capture ratio is used to evaluate how well an investment manager performed relative to an index during periods when that index has exhibited negative performance. Average Drawdown is the average observed loss from a peak to a trough during a specified time period. Correlation measures the strength of the relationship between the relative movements in price of two securities.

Important Risk Information

Mutual Funds involve risk including the possible loss of principal.

The Fund is a ‘fund of funds’ and typically invests in other investment companies and exchange-traded funds (ETFS”). Costs of investing in the Fund are generally higher than direct investments and investors may bear the fees, expenses, and brokerage costs charged by the ETFS. ETFS carry security, market and sector risks, and may not perform as expected which could result in a decline in value. When the Fund invests in ETFs that own fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. The use of leverage and inverse leveraged ETF’s may exaggerate changes in price and return. Accordingly, values may be more volatile and the risk of loss magnified when compared to non- leveraged investments. Other possible risks to the Fund include those related to investment in small and medium-sized companies, general risk, ETF Risk, Equity Securities Risk, Fixed Income Securities Risk, High Yield Risk, Large-cap Securities Risk, Growth Risk, Fund of Funds Risk, Sector Risk, Management Risk, Interest Rate Risk, Leveraged, Inverse and Inverse- Leveraged ETF Risk, Real Estate Investment Risk, Commodity Risk, High Volatility Risk, Derivatives Risk, Futures Risk, Options Risk, Portfolio Turnover Risk, and Cyber Security Risk. Please review the prospectus carefully for additional details.

Shares of the Innealta Capital Funds are currently offered only in the United States to U.S. investors and are not available for sale in any jurisdiction other than the United States. The information on this Web site should not be considered a solicitation to buy or an offer to sell shares of the Innealta Capital Funds in any jurisdiction where it would be unlawful under the securities law of that jurisdiction.

Additional Information

Advisory Services are offered through Innealta Capital, LLC, an Investment Adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. No federal or state agency or regulatory or self-regulatory authority has approved the information contained in this website, and any representation to the contrary is unlawful. A copy of our Form ADV Part 2 is available below.

Innealta Capital, LLC’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy.

This website and articles contained herein may contain testimonials from current or former clients, or endorsements from other persons that are supporting or recommending the activities of the Firm. Such individuals may be compensated directly or indirectly by the Firm for the use of their statements. The statements represent the testimony or endorsement by that individual only and may not represent the experience of all counterparties.